Chinese language Startup DeepSeek Disrupts AI Market

A brand new low-cost Chinese language synthetic intelligence mannequin is wreaking havoc within the know-how sector, with tech shares plummeting globally as considerations develop over the potential disruption it might trigger. Information of the launch prompted widespread selloffs from Tokyo to New York, with main AI leaders like Nvidia taking vital hits.

Chinese language startup DeepSeek launched a free AI assistant final week that it claims makes use of much less information and operates at a fraction of the price of its rivals. By Monday, DeepSeek’s assistant had surpassed U.S. rival ChatGPT in downloads from Apple’s App Retailer. This improvement raised fears in regards to the dominance of present market leaders within the AI house.

The Nasdaq Composite Index tumbled greater than 3%, with Nvidia’s shares plunging over 17%, marking its largest single-day loss ever. Based on LSEG information, Nvidia’s market worth was on monitor to drop greater than $600 billion — greater than double its earlier document one-day loss final September. Different main tech gamers had been equally affected: Broadcom fell over 18%, Microsoft, a backer of ChatGPT developer OpenAI, slipped 2.3%, and Alphabet dropped 3.4%.

The Philadelphia Semiconductor Index aced its largest decline since March 2020, tumbling greater than 10%. The selloff started in Asia, the place Japan’s SoftBank Group fell 8.3%, and continued by way of Europe, with ASML sliding 7%.

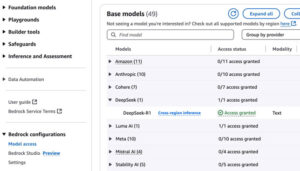

DeepSeek, a Hangzhou-based startup, unveiled its DeepSeek-R1 model final week, reportedly 20 to 50 occasions cheaper to make use of than OpenAI’s comparable mannequin. The innovation has drawn reward from Silicon Valley leaders, together with enterprise capitalist Marc Andreessen, who likened the breakthrough to AI’s “Sputnik second.”

“DeepSeek R1 is likely one of the most wonderful and spectacular breakthroughs I’ve ever seen,” Andreessen wrote on X.

The startup’s researchers disclosed that their DeepSeek-V3 mannequin, launched on January 10, was educated utilizing Nvidia’s H800 chips, costing lower than $6 million. This marked a stark distinction to the billions invested by rivals reminiscent of OpenAI and Alphabet in AI improvement.

Investor nervousness unfold quickly because the implications of DeepSeek’s cost-efficient mannequin grew to become clear. Brian Jacobsen, chief economist at Annex Wealth Management, described the event as a possible “disruption of all the AI narrative that has pushed markets during the last two years.”

“It might imply much less demand for chips, diminished want for large energy manufacturing, and fewer large-scale information facilities,” he mentioned in an interview. “Nonetheless, it might additionally democratize AI and allow a wave of recent purposes.”

Shares of corporations tied to AI infrastructure noticed steep declines. Information middle builder Vertiv Holdings plummeted greater than 30%, whereas utility corporations that just lately benefited from AI-related demand projections additionally fell sharply: Vistra dropped 28%, Constellation Energy misplaced 20%, and NRG Energy was down greater than 14%.

Not everybody considered the selloff as justified. Daniel Morgan, senior portfolio supervisor at Synovus Belief Firm, known as the market response an overcorrection.

“DeepSeek’s AI mannequin competes with ChatGPT, Meta Platforms, and Alphabet’s Gemini, however its focus is on cellphones and PCs relatively than information facilities,” he famous in an interview. “The actual cash in AI continues to be in offering chips for information facilities, which stays Nvidia’s energy.”

Nonetheless, Nvidia shares had been final down over $24, buying and selling at $117.69, marking a document each day loss. The inventory, which soared 171% in 2024 and 239% in 2023, now trades at 56 occasions its earnings, in comparison with the Nasdaq’s a number of of 16.

The hype round AI has pushed unprecedented capital inflows into equities over the previous 18 months, inflating valuations and pushing inventory markets to document highs. As just lately as final Wednesday, AI-related shares rallied after former President Donald Trump introduced a $500 billion private-sector plan for AI infrastructure by way of a three way partnership known as Stargate, backed by SoftBank, OpenAI, and Oracle. Nonetheless, the current selloff underscores the market’s sensitivity to disruptive developments in AI.

Concerning the Writer

John K. Waters is the editor in chief of a lot of Converge360.com websites, with a deal with high-end improvement, AI and future tech. He is been writing about cutting-edge applied sciences and tradition of Silicon Valley for greater than two many years, and he is written greater than a dozen books. He additionally co-scripted the documentary movie Silicon Valley: A 100 Yr Renaissance, which aired on PBS. He may be reached at [email protected].